The Only Guide for G. Halsey Wickser, Loan Agent

Table of ContentsThe Buzz on G. Halsey Wickser, Loan AgentAll about G. Halsey Wickser, Loan AgentThe 4-Minute Rule for G. Halsey Wickser, Loan AgentSome Known Factual Statements About G. Halsey Wickser, Loan Agent Not known Details About G. Halsey Wickser, Loan Agent

When working with a home mortgage broker, you must clarify what their fee structure is early on in the procedure so there are no surprises on closing day. A mortgage broker generally only obtains paid when a lending shuts and the funds are released.Most of brokers do not set you back consumers anything in advance and they are generally risk-free. You ought to utilize a mortgage broker if you wish to find access to home finances that aren't easily marketed to you. If you don't have outstanding credit, if you have an one-of-a-kind borrowing circumstance like possessing your own company, or if you just aren't seeing home mortgages that will help you, after that a broker could be able to get you accessibility to fundings that will certainly be helpful to you.

Home mortgage brokers might also have the ability to aid funding candidates get a lower rate of interest than a lot of the commercial financings offer. Do you require a home loan broker? Well, collaborating with one can conserve a debtor effort and time throughout the application process, and possibly a great deal of cash over the life of the car loan.

Excitement About G. Halsey Wickser, Loan Agent

A professional home loan broker stems, negotiates, and refines residential and industrial home loan in support of the customer. Below is a 6 point guide to the services you ought to be used and the expectations you must have of a competent mortgage broker: A home mortgage broker provides a wide variety of home loan from a variety of different lending institutions.

A home loan broker represents your rate of interests rather than the interests of a loaning establishment. They must act not only as your agent, however as an experienced consultant and trouble solver - mortgage broker in california. With accessibility to a large range of home mortgage products, a broker has the ability to provide you the best worth in terms of rate of interest, payment amounts, and funding items

Lots of situations demand more than the simple usage of a 30 year, 15 year, or adjustable price home loan (ARM), so cutting-edge home loan approaches and advanced options are the benefit of functioning with an experienced mortgage broker. A mortgage broker navigates the client through any circumstance, handling the process and smoothing any kind of bumps in the roadway along the method.

G. Halsey Wickser, Loan Agent Fundamentals Explained

Debtors who discover they require larger loans than their bank will certainly accept also benefit from a broker's understanding and capability to successfully get funding. With a home loan broker, you just need one application, as opposed to finishing forms for every individual lending institution. Your home loan broker can give a formal comparison of any type of finances recommended, leading you to the info that precisely represents expense distinctions, with existing prices, factors, and closing prices for every car loan reflected.

A trustworthy mortgage broker will certainly disclose just how they are spent for their services, in addition to information the complete prices for the finance. Customized service is the setting apart variable when choosing a mortgage broker. You must anticipate your mortgage broker to assist smooth the means, be readily available to you, and suggest you throughout the closing procedure.

The journey from dreaming about a brand-new home to in fact having one might be filled up with obstacles for you, especially when it (https://www.metal-archives.com/users/halseyloanagt) comes to protecting a mortgage in Dubai. If you have been presuming that going straight to your financial institution is the finest path, you may be losing out on a much easier and potentially extra useful option: working with a home loans broker.

G. Halsey Wickser, Loan Agent Things To Know Before You Buy

Among the substantial advantages of using a home loan specialist is the specialist economic recommendations and necessary insurance coverage assistance you obtain. Home loan experts have a deep understanding of the various monetary items and can help you pick the best mortgage insurance policy. They make certain that you are sufficiently covered and provide suggestions customized to your monetary circumstance and lasting goals.

This process can be overwhelming and taxing for you. A mortgage brokers take this worry off your shoulders by taking care of all the documentation and application procedures. They know precisely what is called for and make sure that every little thing is finished accurately and in a timely manner, minimizing the threat of delays and errors. Time is cash, and a mortgage broker can conserve you both.

This implies you have a much better possibility of locating a home mortgage finance in the UAE that flawlessly matches your demands, consisting of specialized items that could not be readily available with typical banking channels. Navigating the mortgage market can be complicated, particularly with the myriad of products offered. An offers specialist support, helping you understand the pros and disadvantages of each choice.

Some Ideas on G. Halsey Wickser, Loan Agent You Should Know

This expert recommendations is important in protecting a home loan that lines up with your monetary objectives. Home loan consultants have actually developed connections with many lenders, offering them significant working out power.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Raquel Welch Then & Now!

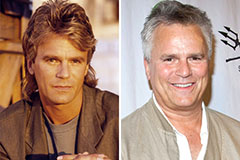

Raquel Welch Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!